Philosophy

Real wealth is created through the power of compounding when owning successful companies that grow EPS over long periods of time.

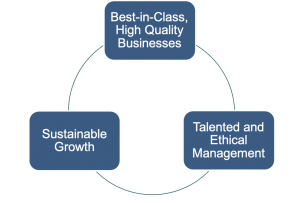

We believe quality growth investing is a durable, repeatable process that delivers excess returns over complete market cycles. We also believe stock performance is highly correlated with growth in earnings per share. Real wealth is created through the power of compounding when owning successful companies that grow EPS over long periods of time. We are growth managers who believe that the individual characteristics of a business are far more important than its size. We prefer to operate across the full market capitalization spectrum and own those companies for long periods of time. DF Dent’s approach to investing incorporates companies that fit our three core investment characteristics:

We strive to adhere to our disciplines of primary research, objective valuation analysis, and patience. We firmly believe that the constant application of these disciplines protects our portfolios from the temptation of buying into investment fads and “popular” stocks.